How to calculate the financial stress levels of your ratepayers

A How-To-Guide

First it was COVID,now it is a double dose of inflation & interest rates causing a new wave of hardship for Australian ratepayers.

According to a new survey conducted by NAB, 20% of Australians have been unable to pay their mortgage or a critical bill at least once during the last three months.

As stress mounts, the challenging part for local government leaders is knowing exactly how “big” this problem actually is within their local community.

What are red and green ratepayers?

Regardless of market conditions, two types of ratepayers will always exist in any economic climate.

Top ratepayers (referred to herein as ‘green’ ratepayers) are those individuals who despite market conditions will always pay on time. This is due to a number of factors including high household income, high household savings, psychological attributes (i.e. organised personality) & payment history. Green ratepayers account for approximately 3-8% of the total ratepaying population.

Negative ratepayers (referred to herein as ‘red’ ratepayers) are those individuals who are already in a state of financial stress despite market conditions. This group also includes individuals who do not treat their financial obligations to third parties seriously and are often in periods of arrears & default. Red ratepayers account for approximately 3-5% of the total ratepaying population

What are ‘invisible ratepayers’ ?

Unlike red and green ratepayers, the vast majority of individuals are classed as ‘invisible.’ This means that both their level of payment stress and ability to pay is completely unknown. The only indicator councils can use to determine this is historic payment data, however this is often hard to access in ERP/CRM systems and even then, only indicates whether a ratepayer has been in arrears historically, not whether they are likely to be facing stress now.

Do red, green and invisible ratepayers change during an economic recession?

In times of economic hardship, a higher percentage of the population shifts over time from the green & invisible zone to the red zone. This has several impacts on councils:

- Reduced customer satisfaction as hardship increases

- Increased arrears volume

- Increased collections

- Increased calls to council around arrangements/hardship measures

How can councils respond to this effectively?

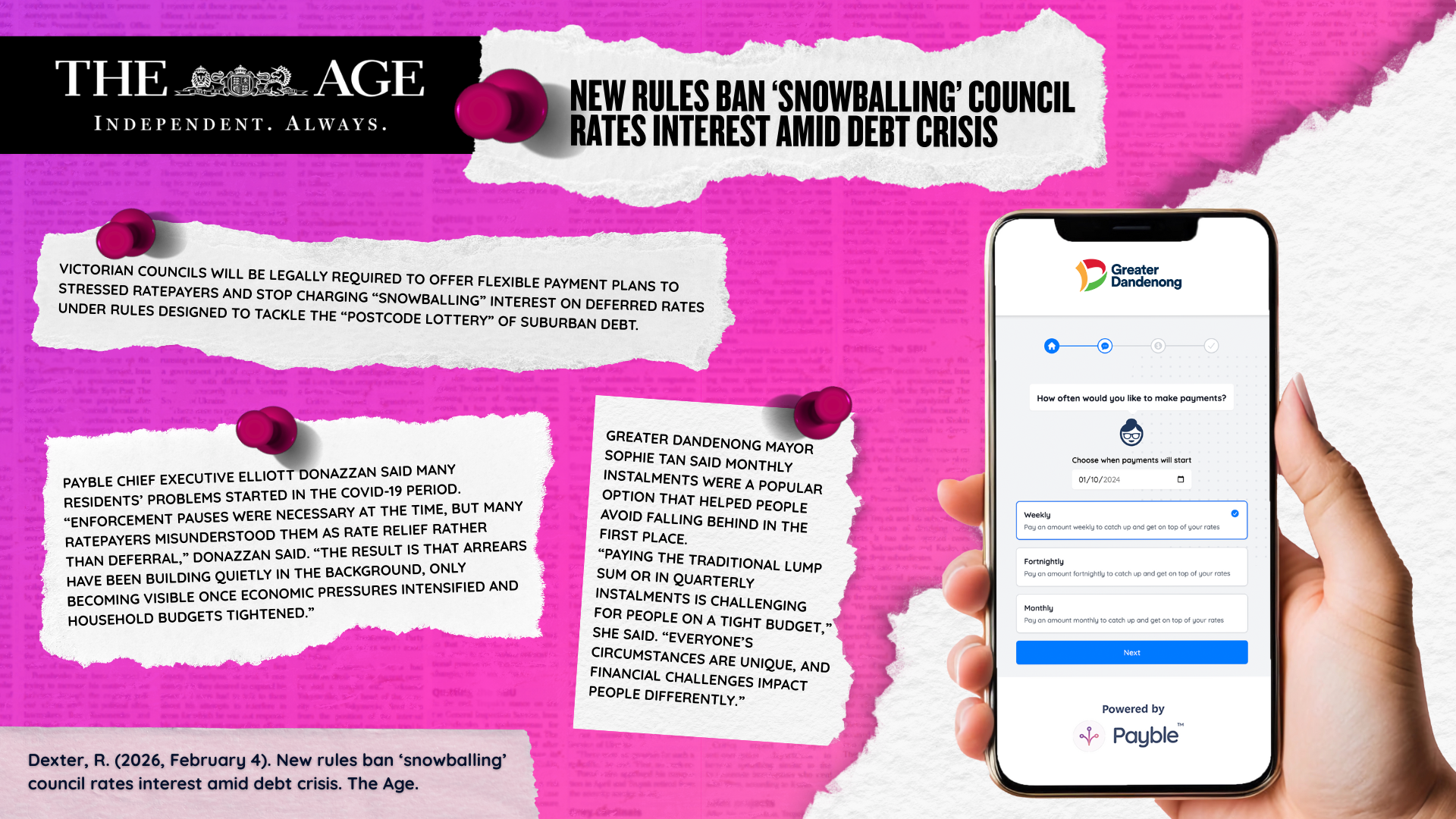

Rather than responding to changing market conditions reactively; councils can become proactive by using technology like Payble to reach out to ratepayers to determine their level of financial wellbeing before events like arrears come into play. In this way, options can be prepared and offered to reduce payment stress & reduce the future burden on the individual & council management.

In addition, if this technology is used regularly, councils can even begin to predict payment failures and arrears before they happen!

Can you show me an example?

Using the Payble Pulse feature - you can determine the level of stress for your residents in three easy steps.

Step 1: - Select our billing sentiment pulse check from the menu

Step 2 - Choose an audience for sending

Upload a CSV of your resident data or connect our platform to a tool like Infor Pathway, TechnologyOne or Civica Authority

Step 3 - View and triage who needs help via our interactive dashboard

Want to try this out in your council?

Get in touch with us here and we can set you up with a free version of the Payble Pulse tool & also demonstrate our other products driving value for local government bodies around Australia

.jpg)