Hey, so that happened.

Hey, so that happened.

I'm talking about the pandemic, and I will do my best not to repeat that word as I am as sick of talking about it as you.

But it happened. And it’s still around - although we are learning to get on with life and doing business. So, before we end 2022 (not a typo), please ask yourself these three things…

1. What was the impact to your business financially?

2. What was the impact to your business operationally?

3. How did your customers rate your response?

Ok, so before you answer these questions, how about we set the scene first. Perhaps things were steady, stable, and the cashflow was business-as-usual. This is called living in the comfort zone. Perhaps it’s the predictable, safe, yet incomplete world you know.

But then, it happened. You were impacted financially, operationally, and were talked about - or talked to - by your customers.

No go ahead and do your sums.

But then, it happened. You were impacted financially, operationally, and were talked about - or talked to - by your customers.

OK we are back.

So now you have a dollar or percentage figure for the financial impact. Have you seen a recovery? I hope so. Have you factored in the opportunity cost lost of two years of distraction of an epic nature?

You probably don’t have a numeric label to the operational impact but let’s list some of the big ones…

- Toll on your workforce (work and home life)

- Impact of letting people go, then not being able to re-hire

- Supply chain issues

- Compliance

- Admin. Admin. Admin

OK so every single person in every single business has been impacted – significantly.

And the final question was about customers – did the number of inbound calls rise materially? Was there an increase in the number of complaints? Did you lose customers? Was your NPS score impacted?

So, you may be in a hole. Or you may be starting to climb out of it. But are you putting what you’ve learned to good use? Do you want to simply recover, or do you want to excel?

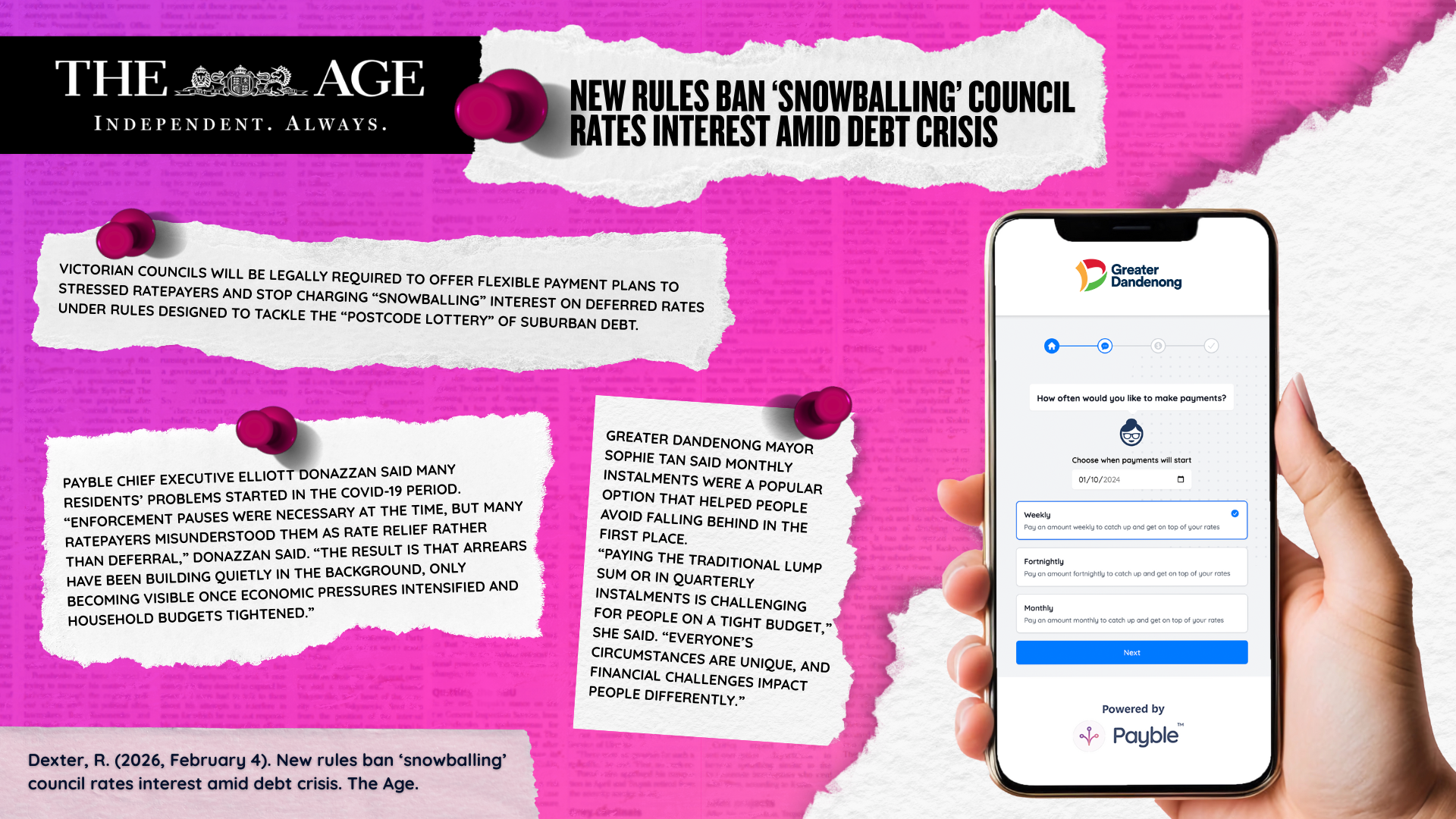

During the chaos, Payble sought to research and help address these three areas of impact. This included research into how we could help businesses like yours increase revenue and reduce costs, save time for your staff, and improve your customer experience.

So what has the Payble response been? We want to focus on improving customer experience by starting with better understanding customer sentiment towards their bills and invoices. No one like bills. But do you think that asking your customers if they are likely to pay on time or need to see flexible payment options is going to put a smile (albeit brief) on their face and improve customer satisfaction?

What about smart notifications and friendly prompts and links to make payments or instalments? Do you think that will save you operational time spent chasing payments or with disgruntled customers– we call this proactive repair. You can avoid writing off bad debts or referring to collections.

And amongst all of this you can increase your revenue and take the stress out of the process for both your business and the customer.

So Payble can help you get out of that hole and past that previous state of comfort where your business can excel.

And next time we face an event like this – you will be prepared to manage the financial, operational and customer impact from the outset.

Why not try our demo today?