Victoria: Local Government Amendment (Rating Reform and Other Matters) Bill 2022

Giving ratepayers a fair-go

Background

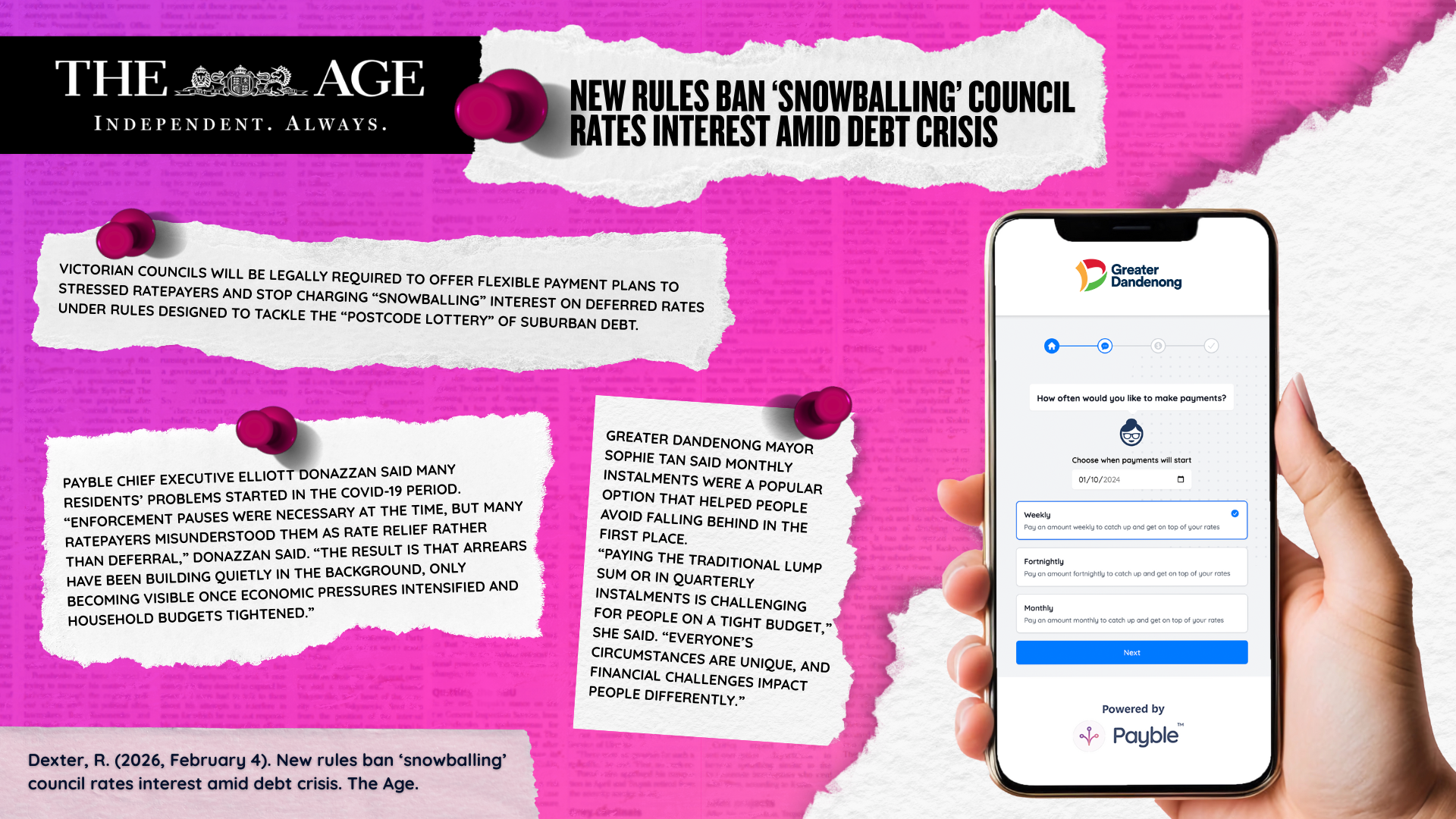

The Victorian Minister for Local Government, Shaun Leane, has introduced legislation into Parliament to help define ratepayer financial hardship policies for councils.

“We know that many Victorians are doing it tough and that’s why we are working to reform the rating system,”

- Victorian Minister for Local Government, Shaun Leane

“Good hardship relief schemes strike a balance where the rate burden is shared while ensuring people in hardship are not driven further into debt or out of their homes.”

This is the State Governments response to the release of the Local Government Rating System Review and the Ombudsman’s ‘Investigation into how local councils respond to ratepayers in financial hardship’ report, with recommendations relating to greater support for ratepayers in financial hardship.

The Ombudsman’s report found that people who were struggling to pay their rates were often meet with debt collectors, high penalty interest and in some cases costly litigation.

“This creates more stress and fear for those who are already struggling financially and or dealing with a range of compounding issues, including family violence and mental health, said Minister Leane.

This is what Payble calls “billxiety” – the avoidable feeling of distress and anxiety caused by a bad billing or payment experience.

Impact to Local Governments

Councils will no longer be able to use debt collectors or pursue legal action – which can result in homes being sold to pay back debts to council – unless ratepayers refuse to engage and all other options have been exhausted.

The Bill will allow the Minister, in consultation with the Essential Services Commission, to set a maximum amount of interest levied on unpaid rates and charges.

The legislation has been welcomed by Financial Counselling Victoria (FCVic) that will require Councils to be more consistent and community-minded when dealing with rate payer debt.

For many years, financial counsellors have observed Councils behaving harshly and aggressively towards residents in hardship,”

- Dr Sandy Ross, FC Vic’s Executive Officer

How Payble can help

Payble’s mission is to end billxiety – the avoidable feeling of distress and anxiety caused by a bad billing or payment experience.

Payble is the flexible billing add-on that improves customer experience by better providing a better solution for Councils to engage with their ratepayers about rates payments.

Local Governments can offer their rate payers payment flexibility – such as flexible instalments where residents can select their start date and preferred frequency – and the ability to skip and rebalance remaining instalments if they need further payment flexibility.

Our mission has always been to improve communication and engagement between Councils and their residents.”

begins Payble Managing Director, Elliott Donazzan

Payble is easy to setup, has integrations with existing ERPs and payment solutions and is 100% cloud-based.

Under the slated Bill, Clause 13 inserts new section 180A sets out the circumstances in which a Council is prevented from commencing a proceeding for the recovery of an unpaid rate or charge.

New section 180A(1) prevents a Council from commencing a proceeding under section 180(1) for an unpaid rate or charge that has not been deferred under section 170 or been subject to a payment plan unless—

• the Council notifies the person in writing and advises them of available payment options, including deferrals and payment plans; and

• it has been at least 24 months since that occurred and the person has not deferred the payment, entered into a payment plan or used any other available payment option.

Payble provides Council the ability to offer flexible payment plans in line with the proposed legislation.

The Customer pyramid

Payble is not just designed to improve engagement with those in hardship. It aims to service all members of the community. This includes everyone who pays council, everyone who wants more flexibility with their payments, those with payment stress, those in arrears, and finally those in collections or litigation.

“Payble can transform the world of paper-based payment arrangements to a future of customer-led proactive engagement”

continues Donazzan.

Many councils are investing in their digital transformations and Payble should be a strategic consideration that cannot be delayed.

Next steps

The Legislation is currently being taken to the Legislative Council for approval.

Getting on the front foot of this legislation will help your Local Government improve engagement with all residents, help you collect more revenue and meet or exceed the expectations of the Minister.

Payble will continue to work with industry and government to ensure Victorian ratepayers are given a fair go.

Please contact us on hello@payble.com.au for a free demo

Other media enquiries, please contact Elliott Donazzan

Further information

Further information about the Bill can be found here

https://content.legislation.vic.gov.au/sites/default/files/bills/591192exi1.pdf

https://www.localgovernment.vic.gov.au/our-programs/council-rates-and-charges

.jpg)